How to Overcome the biggest challenges that female leaders face in business ownership

The National Association of Women Business Owners (NAWBO) reports that there are currently more than 11.6 million U.S. firms owned by women, which employ nearly 9 million people and generate $1.7 trillion in sales. However, Rebecca Harris, executive director of the Center for Women’s Entrepreneurship at Chatham University. says that "90% of all women-owned businesses are sole proprietors, meaning only 10% are hiring employees."

These two differing statistics are wild to me. As a female business coach, I speak to female business owners and leaders all day long and I know that most of them would love to add 3-4 additional team members to their teams.

The single biggest challenge many female business owners face is a lack of capital to grow, and a difficult time forming a lending relationship with a bank -- and the result is that many businesses are successful, but can't reach the next level, or can't expand beyond a narrow market.

According to an alarming study by business lender Fundera:

- Female entrepreneurs ask for roughly $35,000 less in business financing than men.

- Only 1 in 4 applicants for business financing through Fundera were women, and a similar percentage of women end up receiving financing relative to men.

- Women get approved for debt funding at a lower rate than men, but even more startlingly, women are likely to pay higher rates and receive less debt funding than male counterparts.

- Of the women who do secure debt financing, they are more likely to receive a shorter-term loan with less capital and significantly higher interest rates.

- Women entrepreneurs get offered smaller loans across every product, from the same groups of online lenders, with no exception, and pay significantly higher interest rates than men do.

Given these disturbing facts, establishing good personal credit, and building relationships with lenders is a critically important initiative.

Some possible solutions for your consideration include:

- Begin networking with lenders WELL BEFORE you apply for funding. Developing close relationships -- and understanding which loan products you qualify for -- is extremely important.

- Pay close attention to your personal credit and pay down or eliminate credit card debts whenever you can.

- Share information -- including your business plan and financial information -- with a lender and provide an honest assessment of your accomplishments and areas that still need more work.

- Many bankers are looking for business clients, so do homework upfront and make sure you are networking with business-oriented lenders who loan to small businesses.

- Find banks and alternative lending providers that have a specific interest in helping female lead organizations.

While women-owned businesses face unfair obstacles, the key is to overcome the challenges and not get discouraged. Find a group or organization that helps you meet and network to make these strong business connections.

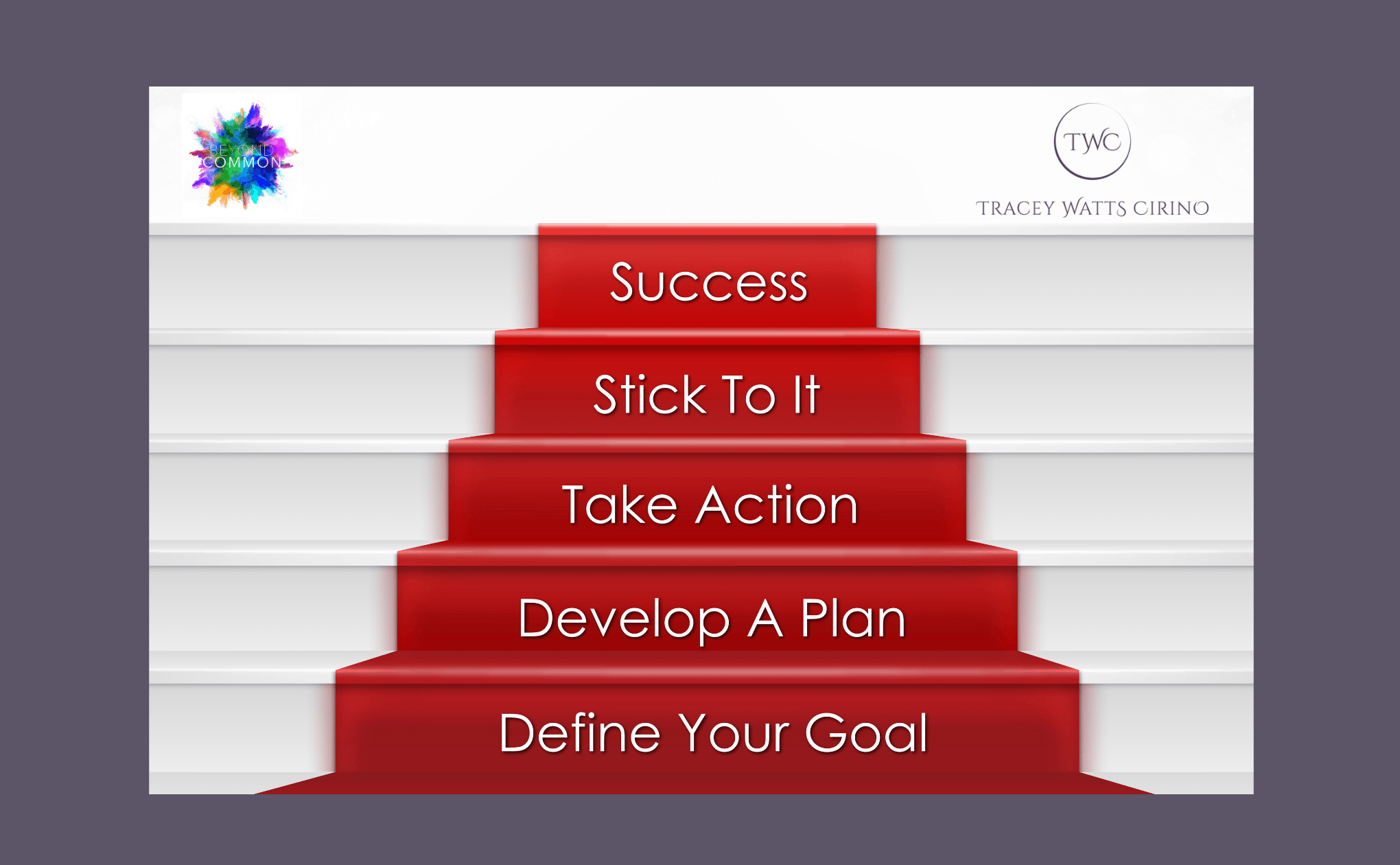

At Beyond Common Coaching and Training Co., we are completely focused on helping our clients achieve success by moving forward with a map of exactly what it takes to get there. No matter where you are if there’s is a gap between where you want to be and grow your business and where you currently are we can help.

Before you start networking with lenders, consider working with us to establish clarity and focus around your personal and professional goals, and creating a compelling mission and vision for your business, including a detailed business map.

We have many products to help our clients achieve results even quicker on their journey to successful business ownership:

"12 Business Success Secrets" Free Report delivered right to your inbox when you sign up at www.BeyondCommonBusinessSecrets.com

or check out our book Beyond Common 12 Essentials for Success in Life and in the Workplace to get your whole team speaking the same language.

You are also invited to listen to our Podcast: Beyond Common Business Secrets

Your success is important to us -- be sure to let us know how we can help you!

Comments